The Primary Residence Credit (PRC) was established during the 2023 Legislative Session under House Bill 1158. The credit provides all North Dakota homeowners with the option to apply for a state property tax credit through the North Dakota Office of State Tax Commissioner.

Homeowners with an approved application may receive up to a $500 credit against their property tax obligation.

To be eligible for the credit, you must own a home (house, mobile home, town home, duplex, or condo) in North Dakota, and reside in it as your primary residence.

There are no age restrictions or income limitations for this credit.

Only one Primary Residence Credit is available per household.

The 2025 application period is now open. Apply using the button below:

2025 Primary Residence Credit Application

Have Questions? Contact us at:

Phone: 701-328-7988

Toll Free: 1-877-649-0112

Email: taxprc@nd.gov

2025 Primary Residence Credit Flyer

Those applying for the credit may be eligible to apply for more than one type of property tax credit, including the Homestead Property Tax Credit and the Disabled Veterans Property Tax Credit.

Additional information on other credits and exemptions can be found here:

Property Tax Credits & Exemptions

Primary Residence Credit FAQ’s

Who is eligible to apply?

Anyone who owns and occupies a dwelling in North Dakota and uses it as their primary residence.

What is considered a primary residence?

A dwelling occupied by an individual as their primary or principal residence.

How and when do I apply?

The 2025 application period for the Primary Residence Credit will open on Tuesday, December 3, 2024

What is the Primary Residence Credit amount?

The Primary Residence Credit amount is up to $500 for an approved application and cannot exceed the amount of property tax due.

Is there a paper application process for the Primary Residence Credit?

No – the application process is online only.

If I don’t have access to the internet, how do I apply?

You can reach out to our office at 701-328-7988 or 1-877-649-0112 for assistance.

Can an individual who owns more than one home claim more than one primary residence?

No – an individual may not have more than one primary residence.

Can persons who reside together as spouses claim more than one Primary Residence Credit?

No – only one Primary Residence Credit is available per household.

(Persons who reside together, as spouses or when one or more is a dependent of another, are entitled to only one Primary Residence Credit between or among them)

If my Primary Residence Credit application is approved, when will I receive my credit?

Constructed or manufactured home on a lot you own: Upon approval, the credit will be shown as a deduction on your 2025 property tax statement (your 2025 statement will be mailed to you in December, 2025).

Mobile or manufactured home on a lot you lease, paying property taxes in advance: In addition to completing the Primary Residence Credit application, you will also have to apply for a refund or abatement of taxes already paid for 2025 through your county for the same year, by filling out the Application for Abatement or Refund of Taxes Form and submitting it to your county for approval.

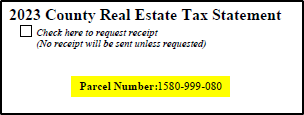

How do I find my Parcel Identification Number?

Your Parcel Identification Number is shown on the top left corner of your property tax statement.

Can an individual be eligible for more than one type of property tax credit?

Yes - If you have been approved for the Homestead or Disabled Veteran’s Property Tax Credit and still have a balance due, you can receive an up to $500 Primary Residence Credit for any remaining property taxes owed.